RIVA Recruitment’s Director, Fabian Ruggieri has put together a Funds Management BDM Salary Guide and Market Update for 2024

Industry update

The funds management distribution market in Australia has remained buoyant over the past 12 months, and we anticipate a strong 12-months ahead as global investment markets reach all-time highs. The strength in the funds business development employment market can be attributed to the shortage of skilled business development professionals, and new investment products coming to market, namely private equity, and private credit funds.

Over the previous 12 months, we have continued to see Business Development Managers’ (BDM) salaries increase, especially in the intermediary/wholesale channel. Furthermore, given the headwinds in the institutional market, we continue to see multiple institutional BDMs seek a pivot to wholesale distribution.

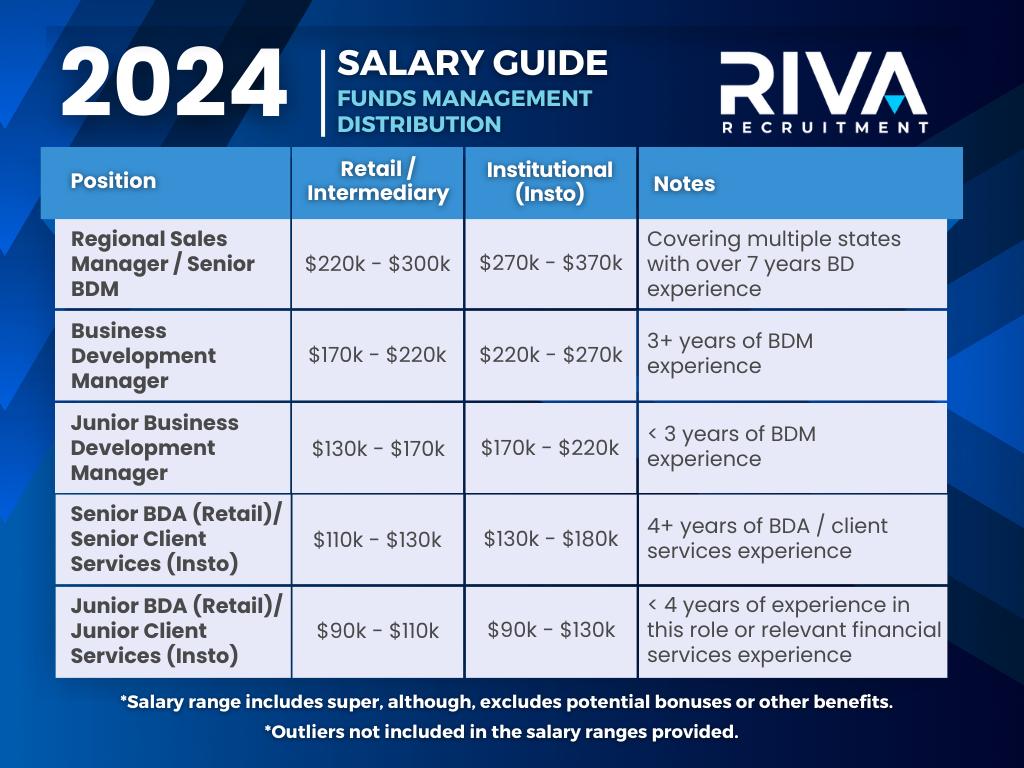

Funds Management Distribution Salary Guide

Business Development Bonuses

Bonuses over the last 12 months were slightly lower than the previous year for equity managers covering listed equites, as majority of active fund managers have struggled to raise substantial capital. However, managed accounts, passive funds, private equity, and private credit markets continue to drive inflows, resulting in increased bonuses for BDMs representing these asset classes and/or products. Majority of business development professional received a bonus between 30% – 70% of their base salary over the last 12 months, with top performers receiving bonuses of over 90% of their base salary.

Business development associates’ bonuses range from 10% to 30% of their base salary. Majority of associates received 10% – 20% of their base salary as a bonus over the past 12 months.

Financial Advice / Intermediary Market Update

- Managed accounts continue to grow, along with the growth of asset consultants

- Asset consultants are having greater control over financial advisers’ allocation of client capital

- With the number of financial advisers in Australia reducing by ~35% to ~15,000, and more advisers engaging in asset consultants, there are less clients for retail Business Development Managers’ (BDM) to target

- Financial advisers are moving away from institutionally aligned dealer groups and are joining boutique dealer groups or becoming self-licenced, resulting in the advice firm having greater control over their investment approved product list (APL)

- Several licensees are building out their own managed account offering

- Distribution teams are focusing on financial advice firms dealing with high-net-worth (HNW) wholesale clients, who are constructing bespoke investment portfolios for their clients.

Institutional Market Update

- ‘Your Future, Your Super’ legislation has resulted in super funds being more benchmark aware

- Several industry funds have merged creating greater economies of scale, resulting in compressed fees for external asset managers

- With consolidation of super funds, there are less clients for institutional BDM’s to cover

- Industry super funds are moving towards internalised investment capability

- Super funds continue to drive positive ESG changes in the companies they invest directly in and the asset managers they allocate mandates to

- Several Australian funds management firms are targeting global institutional asset owners, as margins are higher.

Contact Us

RIVA Recruitment specialises in funds management recruitment across Australia. If you are seeking a new employee for your distribution team or you are seeking an new employment opportunity, please feel free to contact us via LinkedIn, on 0434 943 647, or email us at enquiries@rivarecruitment.com.au for further information.