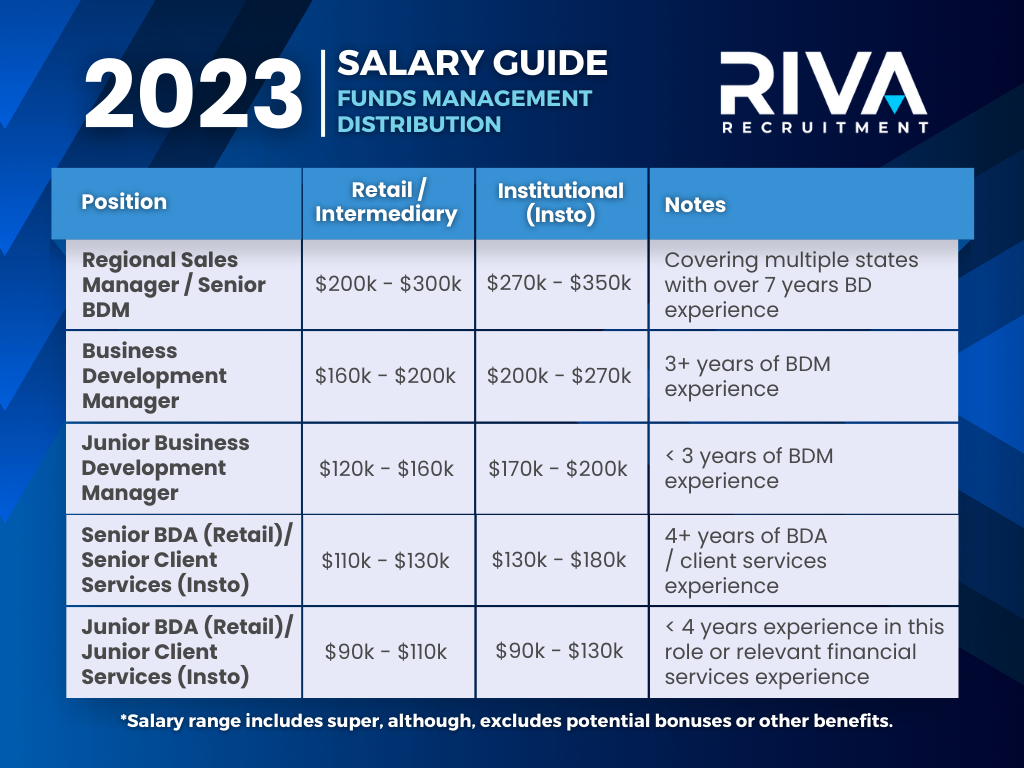

RIVA Recruitment’s Director, Fabian Ruggieri has put together a Funds Management BDM Salary Guide and market update for 2023;

Funds Management Industry Update

The funds management distribution market in Australia has been hot over the past 2 years, and we expect the market to remain buoyant over the next 12 months. The strength in the funds BD market is mainly due to the shortage of skilled business development professionals, increased investment products coming to market, namely ESG Investments and listed products, and a post-Covid share market recovery. Over the last 12 months, we have seen BDM salaries increase, especially in the retail/intermediary channel. Furthermore, given the headwinds in the institutional market, we have seen multiple institutional BDMs seeking a pivot to wholesale distribution.

Business Development Bonuses

Bonuses over the past 12 months have been strong as fund managers aim to retain top performing talent in a candidate driven market. Majority of business development professionals received a bonus between 40% – 70% of their base salary over the last 12 months, with several top performers receiving over 80%.

Business development associates’ bonuses range from 10% to 35% of their base salary. Majority of associates received 10% – 15% of their base salary as a bonus over the past 12 months.

Financial Advice / Intermediary Market Update

- With the number of financial advisers in Australia reducing by ~30% to ~16,000, there are less clients for retail Business Development Managers (BDM) to target

- We have seen an increase in Financial Adviser Salaries over the past 12 months

- Financial advisers are moving away from institutionally aligned dealer groups and are joining boutique dealer groups or becoming self-licenced, resulting in the advice firm having greater control over their investment approved product list (APL)

- Financial advice firms are seeking expert investment advice from asset consultants, resulting in substantial growth for asset consultants

- Financial advice firms are moving to managed account solutions, creating greater operational efficiencies for their business

- Distribution teams are focusing on firms which deal with high net worth (HNW) wholesale clients.

Institutional Market Update

- The recent ‘Your Future, Your Super’ legislation has resulted in super funds becoming more benchmark aware

- Several industry funds have merged creating greater economies of scale, resulting in compressed fees for external asset managers

- With consolidation of super funds, there are less clients for institutional BDM’s to cover

- Industry super funds are moving towards internalised investment capability.

Contact Us

RIVA Recruitment specialises in funds management recruitment across Australia. If you are seeking a new employee for your distribution team or you are seeking an new employment opportunity, please feel free to contact us via LinkedIn, on 0434 943 647, or email us at enquiries@rivarecruitment.com.au for further information.